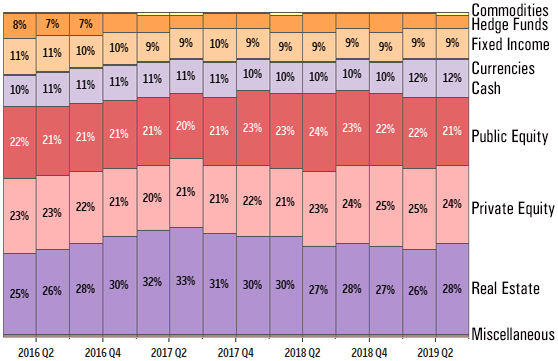

High-Net-Worth Investors As experts in the San Francisco Bay Area and Silicon Valley commercial real estate market, we regularly compare and review national and global investment options. According to the members of TIGER 21, an investment club for high-net-worth individuals, real estate is the highest percentage of their portfolios and is increasing while stocks and holdings are pulling back.¹

High-Net-Worth Investors As experts in the San Francisco Bay Area and Silicon Valley commercial real estate market, we regularly compare and review national and global investment options. According to the members of TIGER 21, an investment club for high-net-worth individuals, real estate is the highest percentage of their portfolios and is increasing while stocks and holdings are pulling back.¹

Real estate values are being driven by geography, affordability, jobs, taxes, and in the Bay Area, tech companies.

Real estate values are being driven by geography, affordability, jobs, taxes, and in the Bay Area, tech companies.

Here are 6 advantages to ‘real asset’ investments:²

● 6-10% yield vs. 1.8% stocks

● Greater total returns

● Inflation protected

● Valuable diversification

● Real and tangible assets

● Recession-resilience

MNM Partners LLC investment strategy specializes in commercial office and multifamily property acquisitions and MNM Property Management expertly improves the value of each property.

Being co-owner of a commercial or multi-family property is tangible and a ‘real asset’ investment that typically offers higher returns over REITs or other ‘financial assets’ of stocks, bonds and cash. Forbes survey of more than 200 HNW investors revealed that even though there’s cash flow and investments growing, there are still challenges in managing their portfolio to 2025. Some of those tasks include building a recession-proof strategy, expanding invested assets, and removing silos.³

¹Trimming Stock Holdings

²2020 Investments

³Forbes High-Net-Worth Portfolios